- Change theme

Why Travel Insurance is Crucial for Personal Injury Coverage

Why should you buy travel insurance to cover personal injury for your next journey?

23:54 10 July 2024

Why should you buy travel insurance to cover personal injury for your next journey? How would you feel if you suddenly fell ill in a foreign country? Would you be prepared for the extra costs and complications of a medical emergency abroad?

Travel insurance is more than just a precaution. It can be your safety net in accidents, diseases, or other disastrous incidents that might occur during your travels. How will it protect you and your loved ones in uncertain times?

Let's discuss why travel insurance for personal injury coverage is important for peace of mind during your travels.

Personal Injury in Travel Insurance Simplified

Travel insurance protects you against unforeseen circumstances that can impede your journey, such as accidents that result in personal injury. Having travel insurance is crucial, especially for situations that may require legal assistance, such as those handled by a Virginia Beach personal injury lawyer.

In Virginia Beach, accidents can happen unexpectedly due to various factors such as traffic congestion, recreational activities, and even natural occurrences like hurricanes. With that, many people reach out to Virginia beach personal injury lawyer to protect themselves from unexpected accidents that may arise. This allows them to secure their peace of mind.

In addition, they navigate the complexities of local laws and insurance claims, helping victims seek compensation for medical expenses, lost wages, and other damages.

Travel insurance usually offers compensation for medical or personal injury, including benefits for medical expenses arising from injuries during your trip, emergency medical evacuation, and repatriation in severe cases. These are urgent issues for personal injury lawyers to consider when weighing potential healthcare costs abroad against the challenges of accessing medical care in foreign countries.

For travelers visiting Virginia Beach, ensuring comprehensive travel insurance coverage can provide financial protection and peace of mind in case of unforeseen accidents or medical emergencies with the help of a personal injury malpractice lawyer.

Advantages of Travel Insurance for Personal Injury

Medical Expense Cover

A travel insurance policy covers the costs of treating travel-related injuries, including hospitalization, surgery, medication, and consultations. This feature assures one of obtaining the required medical attention without spending much of his or her money.

Emergency Medical Evacuation

Travel insurance will cover all expenses if you need to be evacuated to a hospital equipped to handle your serious injury or illness, including repatriation to your country of origin if necessary.

Trip Cancellation/Interruption

A beneficial feature included in certain policies is coverage for the cost of the trip if it is interrupted or canceled due to a personal injury occurring before or during the travel period. As a result, it will reimburse all the non-refundable expenses, including flights, accommodations, and tours.

Accidental Death and Dismemberment

Your travel insurance may pay a benefit if you accidentally die or are permanently disabled due to a covered injury that occurred during your trip. This can provide financial aid to your beneficiaries or help you adjust to life changes following a personal injury.

Legal Advice

Some policies include legal advice and expense coverage for personal injuries resulting from liability claims or lawsuits arising from travel accidents.

Types of Travel Insurance Coverage

Travel insurance can provide the best personal injury coverage if you understand the different policies available. Here are some examples:

- Medical Coverage: These basic travel policies normally cover only emergency medical expenses and evacuation.

- Comprehensive Travel Insurance: Offers extensive coverage that accommodates both medical and non-medical eventualities, such as trip cancellation/interruption, baggage loss, and others.

- Specialized Coverage: Policies designed for adventure sports enthusiasts, seniors, families, or business travelers, offering specific benefits and coverage limits suited to their needs.

Key Considerations When Purchasing

Coverage Limits and Exclusions

Compare the policy's coverage limits, exclusions, and applicable deductible amounts with your travel plans and health conditions.

Destination Specifics

Check if the policy covers medical treatment costs in your destination country, including access to quality healthcare facilities and emergency services.

Period of Insurance Policy

Opt for a policy that covers the entire length of the trip, including any planned extensions, and offers flexibility for changes or extensions if needed.

Efficiency in the Processing of Claims

Find out how easy it is to file claims with an insurance provider, their documentation requirements, and their average processing and reimbursement times.

Travel Assistance Services

Look for a policy with 24/7 travel assistance services that provide medical advice and coordinate emergency medical services, helping you navigate local health systems.

Tips on Getting the Most from Your Travel Insurance

When preparing for your travels, taking proactive steps with travel insurance can significantly enhance your peace of mind and preparedness. Purchase your travel insurance soon after booking your trip to maximize its benefits, including crucial features like trip-cancellation protection.

It's essential to read through the policy's terms and conditions meticulously. Pay close attention to coverage limits, exclusions, and any additional benefits that may apply to ensure you understand the scope of your coverage. Declare any pre-existing medical conditions accurately during the application process to ensure your coverage remains valid.

Failing to disclose these conditions could lead to claim denials. Lastly, keep a copy of your insurance policy, emergency contact numbers, and relevant medical information readily accessible.

These preparations can prove invaluable in navigating unforeseen circumstances during your travels, ensuring you're equipped to handle emergencies efficiently and with confidence.

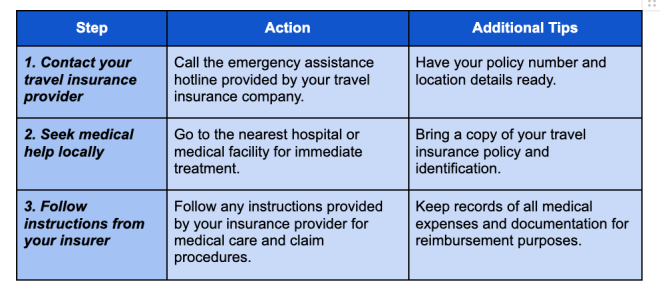

Emergency Medical Assistance While Traveling

Conclusion

Travel insurance is more than just a preventive measure. It serves as an important safeguard against unwanted incidents, particularly personal injury, while traveling.

From medical coverage to emergency evacuations, and peace of mind to unforeseen events, travel insurance provides the comfort that ensures your journey is enjoyed without financial worries.

With knowledge of the importance of personal injury coverage within a travel plan, the right travel policy, and tips, you can embark on a journey with increased confidence and safety, prepared for any eventuality.

FAQs

-

What does travel insurance cover for personal injury?

Travel insurance typically covers medical expenses incurred due to injuries sustained during your trip, emergency medical evacuation, repatriation, and sometimes accidental death or dismemberment.

-

Is travel insurance necessary if I already have health insurance?

Yes, travel insurance is necessary because it covers medical emergencies abroad that may not be included in your regular health insurance. It also includes additional benefits like trip cancellation/interruption and emergency evacuation.

-

Can travel insurance cover pre-existing medical conditions?

It's crucial to review policy details for specific coverage and exclusions. It's crucial to review policy details for specific coverage and exclusions.