- Change theme

What are the key changes that have occurred in the operations of financial institutions in recent years? What is the role of customized banking software solutions?

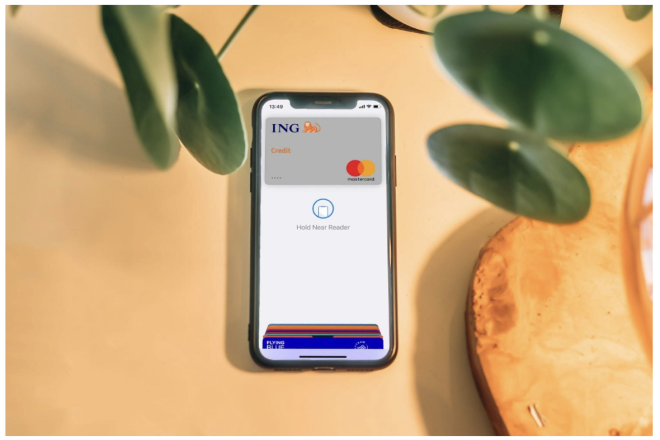

The fintech industry has undergone considerable changes over the past decade, with various customer-friendly implementations.

03:42 28 December 2024

The fintech industry has undergone considerable changes over the past decade, with various customer-friendly implementations that have enabled numerous financial institutions to provide fast, personalized, and secure services. This has been made possible by technological progress, which has provided the opportunity to change the way financial services are delivered dynamically. One of the main drivers of change in the financial sector is the integration of unique software solutions into the complex architecture of core banking systems. In addition to simplifying the execution of banking transactions, banking custom software solutions improve customer interaction, security, and scalability, allowing financial institutions to succeed in an increasingly digital world.

Traditional and modern solutions that have influenced the development of banking systems

Traditional banking systems have long relied on legacy software solutions that are inflexible, isolated, and difficult to maintain. These legacy systems were created at a time when digital banking was not so widespread, these solutions did not take into account the customer experience and operational efficiency. Over time, as technology actively develops, customer expectations change and new competitors emerge, it becomes clear that banks must adapt to all these challenges and new opportunities. Customer expectations include specialized banking software solutions - special tools tailored to the specific needs of individual financial institutions.

The concept of core banking system architecture refers to the basic structure that supports core banking services, such as account management, transaction processing, and customer service. In typical use cases, these systems are typically deployed on-premises, which limits scalability and flexibility. Today, traditional banking systems have evolved into cloud-based solutions that offer greater flexibility, faster updates, and greater security.

Customizing banking software solutions allows you to meet individual customer needs

One of the undeniable advantages of custom banking software solutions is their ability to meet the specific needs of a particular financial institution. Banks, credit unions, and other financial institutions operate in a variety of environments, each with its own regulatory requirements, customer demographics, and business goals. Off-the-shelf software solutions are practical but often fall short of these specific requirements.

Modern custom banking software solutions can be customized to fit your bank or financial institution’s workflows, security protocols, and services. Whether it’s integrating mobile banking features, streamlining loan processing, or improving risk management, custom banking software solutions give banks the flexibility they need to innovate and stay competitive in a financial services market that is under constant pressure from various innovations.

Cloud adoption and its impact on core banking systems

One of the biggest trends in today’s fintech industry is the widespread adoption of cloud solutions. Cloud-based core banking systems have many advantages over traditional on-premise solutions. These systems provide financial institutions with greater scalability so that they can easily expand their services to meet the growing needs of their customers.

The flexibility of cloud solutions also allows banks to implement continuous software updates, ensuring they stay up to date with the latest security patches and service improvements. For example, underlying cloud banking systems can automatically adapt to the needs of a bank’s clientele, matching resources to needs without additional assistance.

Cloud solutions have become one of the key changes that have significantly improved the daily operations of financial institutions in recent years. The implementation of cloud solutions significantly reduces the need for large internal IT departments to manage infrastructure. Financial institutions can delegate this responsibility to cloud technology providers, freeing up valuable resources that can be used to improve customer service and implement important innovations that will provide greater security and better speed of execution of various banking transactions.

Improving customer experience through digital channels

Today's banking customers expect a seamless, intuitive experience through multiple digital channels. Mobile apps, online portals, or even voice assistants: customers want their financial institutions to be accessible anywhere, anytime. With dedicated banking software solutions, banks can offer personalized experiences that meet all of these needs:

- Banks can use dedicated software to create advanced mobile banking features, such as real-time account notifications, voice transactions, and AI-powered financial advice. These features are built on the architecture of the core banking system, which ensures that all data is processed securely and efficiently;

- Banks can integrate new technologies, such as artificial intelligence (AI), machine learning, and blockchain, into their daily operations. For example, AI-powered chatbots can provide 24/7 customer support, answer questions informatively and accurately, process transactions, and even offer personalized financial advice based on customer preferences and behavior. By combining these tools, banks can improve their services while reducing operational costs.

Improving operational efficiency through automation

Operational efficiency is a top priority for financial institutions that want to remain competitive in the fintech sector. Custom banking software allows banks to automate many manual tasks, from account opening and loan approval to fraud detection and compliance reporting.

Custom software, for example, can be used to develop automated lending systems where applications are processed and approved in real-time without the need for manual intervention. Similarly, artificial intelligence and machine learning algorithms can be used to detect suspicious transactions and alert bank staff in real-time, significantly improving security and reducing fraud risks. By integrating different modules such as accounting, customer relationship management (CRM), and transaction processing, banks can eliminate redundant tasks, enabling a more productive workflow.

What are the future trends in fintech and banking software solutions? Why are these trends important?

The financial technology industry is constantly and actively developing, introducing certain beneficial changes to its operations. To remain competitive, modern financial institutions need to stay ahead of new trends. Some of the most promising developments in the fintech industry include:

- Open banking, allows third-party developers to access the core systems of the bank and create innovative financial products and personalized banking services. Open banking will require banks to adopt a more flexible and open-core architecture of the banking system that can easily integrate with external platforms;

- Blockchain and digital currencies. Blockchain technology continues to develop rapidly, it has a strong potential to improve the way banks conduct numerous transactions, and contract management processes. Core banking systems will need to be updated to support integration with blockchain;

- Leveraging AI and machine learning to analyze data and make real-time decisions is becoming increasingly important in banking. Custom banking software solutions can use these technologies to improve everything from credit scoring to fraud detection;

- Embedded finance is the integration of financial services into non-financial platforms, such as e-commerce websites or social media apps. Custom banking solutions will play a key role in creating seamless, embedded financial transactions.

Summary

The fintech industry is evolving rapidly and changing at a breakneck pace, so the demand for custom banking software solutions and the underlying architecture of the banking system will continue to grow. These technologies provide financial institutions with the flexibility, scalability, and security they need to compete in an increasingly digital world. By leveraging customized solutions, banks can offer innovative services, improve customer interactions, and streamline their operations, positioning themselves as a trusted financial environment that provides customers with every opportunity for security and success.