- Change theme

The Impact of Cryptocurrency Accounting on Modern Financial Strategies

Businesses are increasingly facing the daunting challenge of integrating cryptocurrencies into their accounting practices.

05:50 08 October 2024

Businesses are increasingly facing the daunting challenge of integrating cryptocurrencies into their accounting practices. As digital assets redefine traditional concepts of money and value, the lack of clear accounting standards complicates financial reporting and risk management.

Companies must navigate the complexities of classifying and measuring these volatile assets while ensuring compliance with evolving regulations. This blog post explores the intricate realm of cryptocurrency accounting and its significant influence on modern financial strategies, providing insights to help organizations adapt and thrive.

Evolving Landscape of Financial Reporting

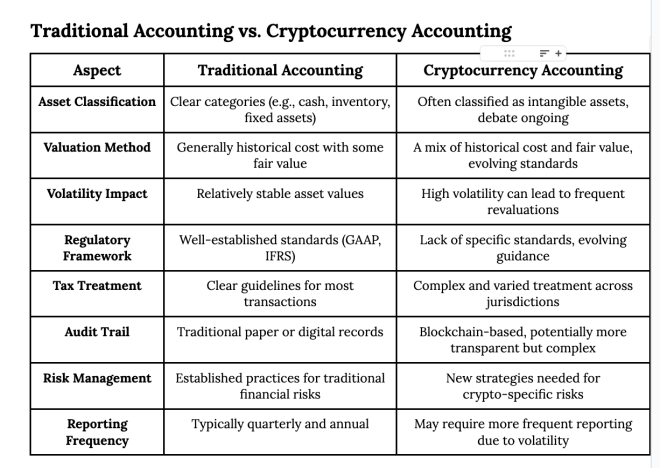

The increased utilization of cryptocurrencies has disrupted traditional structures of accounting, which originally were set up base`d on tangible assets and fiat money. These traditional systems struggle to keep up with accounting for unique features of digital assets related to volatility, decentralization, and anonymity. Thus, organizations reconsider how they present their cryptocurrency holdings and transactions in their financial statements.

A major challenge is a regulatory void; neither the International Financial Reporting Standards (IFRS) nor the U.S. Generally Accepted Accounting Principles (GAAP) provide clear guidance on cryptocurrency accounting, leading to inconsistencies across companies.

This has prompted many organizations to start looking toward specific software and systems for tracking and reporting on digital assets. This is a harbinger of the increased demand for strong financial reporting mechanisms amidst emerging digitally supported processes.

Classification and Measurement of Cryptocurrencies

Virtual currencies are usually classified as intangible assets in most current accounting standards, several issues arise regarding proper reporting. This classification applies to assets like patents or trademarks and does not fully capture the volatile liquid nature of digital currencies.

Intangible assets are measured at cost and subject to impairment testing, which can significantly undervalue cryptocurrencies, especially during market surges. The debate between using fair value or historical cost for measurement further complicates cryptocurrency reporting. While fair value provides a more accurate snapshot of current market value, it also introduces volatility into financial statements.

In response, the Financial Accounting Standards Board (FASB) has introduced provisions allowing for fair value adjustments for certain digital assets, aiming for more dynamic and precise reporting of cryptocurrency holdings.

Impact on Financial Statements

The volatility of cryptocurrency prices presents significant challenges for financial reporting. Large fluctuations in value can result in substantial unrealized gains or losses, directly affecting a company's net income and overall financial health.

Such fluctuations complicate the ability to present consistent financial performance and increase unpredictability. On the balance sheet, cryptocurrency holdings can dramatically alter key financial ratios and metrics, influencing how investors and stakeholders assess the company’s financial stability.

To address these challenges, many companies are adopting advanced risk management strategies, including hedging techniques, diversifying their cryptocurrency portfolios, and limiting exposure to particularly volatile digital assets, thus mitigating financial risk while navigating the unpredictable crypto market.

Tax Implications and Regulatory Challenges

The taxes on cryptocurrency are highly complicated and vary greatly from one jurisdiction to another. This means an international company needs to know the local tax laws on how to report all types of income and capital gains derived from digital assets.

Regulatory bodies are also amplifying their scrutiny of virtual cryptocurrency transactions, further placing a burden of heightened compliance on those involved. Given these challenges, proactive strategies in accounting are needed by the businesses.

This includes implementing robust tracking systems for cryptocurrency transactions, regularly updating accounting policies to reflect evolving regulations, and engaging tax professionals experienced in cryptocurrency matters. Regular internal audits of crypto-related activities can further help organizations maintain compliance and effectively manage their tax liabilities.

Integration of Cryptocurrency Accounting in Financial Strategy

Embracing Digital Assets

Forward-thinking organizations are integrating cryptocurrencies into their broader financial strategies, moving beyond viewing them as speculative assets. This approach requires a comprehensive accounting framework that accommodates the unique potential of digital currencies.

Strategic Opportunities

- Investment Diversification

Adding cryptocurrencies to portfolios offers diversification and the potential for high returns. - Capital Raising

Methods like Initial Coin Offerings (ICOs) and Security Token Offerings (STOs) provide new avenues for raising capital. - International Transactions

Cryptocurrencies enable faster, cheaper cross-border transactions, enhancing global business operations.

Best Practices for Managing Crypto Assets

- Develop clear policies for acquiring, holding, and disposing of cryptocurrencies.

- Implement strong internal controls to safeguard digital assets

- Regularly assess the impact of crypto on financial metrics and risk

- Stay informed about emerging accounting standards

- Ensure transparent disclosures about cryptocurrency activities in financial reports.

Future Directions in Cryptocurrency Accounting

As the cryptocurrency market matures, accounting standards are evolving to accommodate digital assets more effectively. Standard-setters like the FASB and IASB are expected to provide clearer guidelines, ensuring more consistent reporting.

Blockchain technology could transform accounting by offering real-time, transparent, and secure financial reporting. Looking ahead, we anticipate wider adoption of fair value accounting, AI integration, specialized auditing techniques, and greater harmonization of global tax regulations.

To stay ahead, businesses should invest in training, collaborate with peers, explore blockchain solutions, and update financial strategies based on emerging trends.

Conclusion

Cryptocurrency accounting was irrevocably changing the face of modern financial strategy, making businesses transform according to newer regulatory frameworks, risk management practices, and evolving standards. In a world where digital assets are at the forefront, it has become very important for organizations to adopt innovative accounting solutions and keep pace with the trends in the industry.

From navigating tax complexities to using blockchain technology for complete transparency in reporting-all these are things that require proactive steps that would help the companies manage not only the volatility but also the peculiar challenges associated with cryptocurrencies.

Frequently Asked Questions

What is the role of cryptocurrency in modern finance?

It offers decentralized monetary systems with faster, cheaper, and more secure transactions. With cryptocurrency, it's also possible to make cross-border payments and start new classes of assets for investment portfolios.

How does cryptocurrency affect the financial system?

Cryptocurrencies democratize traditional financial systems through decentralized, peer-to-peer networks that allow for greater independence from intermediaries such as banks and increased access to wider, international markets shift in cross-border monetary flow.

How does cryptocurrency affect accounting?

Cryptocurrency complicates accounting even further, introducing problems such as asset classification and valuation, together with regulatory compliance factors that force firms to shift toward new frameworks in reporting and managing digital assets.