- Change theme

How Professional Services Can Help You Manage Your Finances Better

Are you feeling overwhelmed by managing your finances on your own? You’re not alone.

23:47 05 August 2024

Are you feeling overwhelmed by managing your finances on your own? You’re not alone. Balancing financial planning, investments, taxes, and retirement savings can be daunting, especially when you have other responsibilities to juggle.

Professional financial services can provide the guidance and tailored strategies you need to make informed decisions and achieve your financial goals.

Having a team of experts who understand your unique financial situation and can help you navigate the complexities of managing your money. From creating a personalized budget to optimizing your investments and ensuring a comfortable retirement, professional services can significantly enhance your financial health.

In this article, let's explore how professional services can help you manage your finances better and provide you with the peace of mind you deserve.

Identifying Your Financial Goals

Customized financial planning is one of the primary benefits of engaging professional services. Financial advisors work closely with you to understand your specific short-term and long-term financial goals.

They create personalized strategies that address your unique needs, helping you stay on track to achieve your objectives. This individualized approach ensures that your financial plan is aligned with your life aspirations and circumstances.

Another critical aspect of identifying your financial goals is budget analysis and optimization. A thorough budget analysis by a financial professional can reveal opportunities for savings and highlight areas of unnecessary spending.

This process helps you allocate your resources more effectively, ensuring that your financial plan is both realistic and sustainable. By understanding your income and expenses, you can make informed decisions that support your financial goals.

Investment Management

Investment management is a key component of financial health, particularly as AI and the personal finance revolution enhance professional services. These advancements empower financial professionals to excel in asset allocation and diversification, essential strategies for minimizing risks and maximizing returns.

Financial professionals help you create a balanced investment portfolio that spreads your investments across various asset classes. This diversification protects your portfolio from market volatility and improves your chances of achieving consistent growth.

By working with an advisor, you can ensure that your investment strategy is tailored to your risk tolerance and financial goals. Ongoing portfolio monitoring is another advantage of professional investment management.

Regular reviews of your investment portfolio ensure that your investments remain aligned with your financial goals and current market conditions. Financial advisors provide ongoing monitoring and make adjustments as needed to optimize your investment strategy.

Debt Management

Debt management is a crucial aspect of financial health. Creating a plan to pay down high-interest debts efficiently is essential for financial stability.

Financial professionals can assist in developing debt reduction strategies that prioritize your highest-interest debts and help you achieve debt-free status sooner. This approach not only reduces your financial burden but also improves your overall credit profile.

In Michigan, many individuals face the challenges of rising debt levels, high interest rates, and financial instability. Struggling with these financial burdens can make it difficult to maintain a healthy credit score. Debt relief programs play a crucial role in providing structured plans to reduce debt burdens effectively. These programs can help lower interest rates, consolidate payments, and negotiate with creditors, making debt management more manageable. By working with Michigan-based debt relief advisors, you can overcome financial challenges and improve your credit score, paving the way for better financial opportunities and stability.

Tax Planning and Optimization

Tax planning and optimization are critical for enhancing your overall financial health. Tax-efficient investment strategies can significantly reduce your tax liabilities and enhance your returns.

Financial professionals guide you in selecting investments that offer tax benefits, such as tax-deferred accounts and tax-free bonds. By incorporating these strategies into your financial plan, you can maximize your after-tax returns and keep more of your hard-earned money.

Identifying and utilizing applicable deductions and credits can lower your taxable income. A financial advisor can help you navigate the complex tax code to ensure you take advantage of all available tax-saving opportunities. This comprehensive approach to tax planning ensures that you are not leaving money on the table and that your financial plan is optimized for tax efficiency.

Retirement Planning

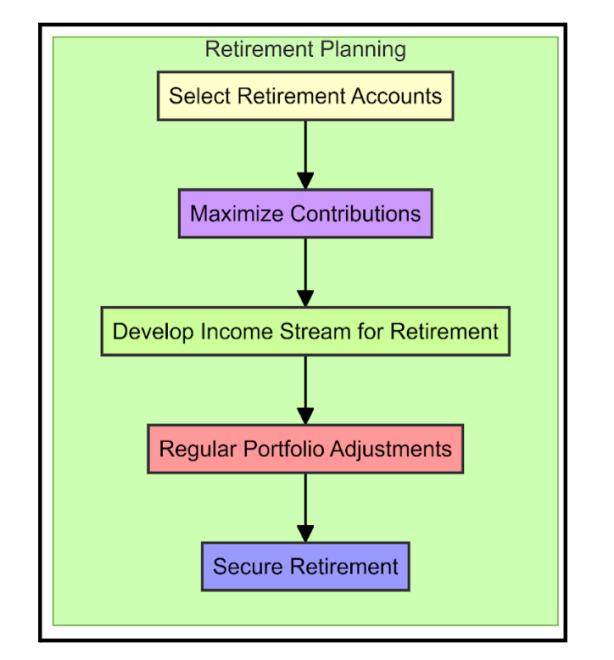

Retirement planning is a crucial aspect of financial management, and professional services provide invaluable support in this area. Retirement accounts management involves choosing the right retirement accounts, such as 401(k)s or IRAs, and maximizing your contributions.

Financial advisors can help you select the most suitable accounts and develop a plan to reach your retirement savings goals. This guidance ensures that you are making the most of the retirement savings vehicles available to you.

Developing strategies to ensure a steady income stream during retirement is essential for financial security. Professional services can assist in creating a comprehensive retirement plan that considers various income sources, including social security, pensions, and investment withdrawals.

By planning for a steady income stream, you can enjoy a comfortable retirement without the stress of financial uncertainty.

Estate Planning

Estate planning is another critical area where professional services can make a significant impact. Wealth transfer strategies help ensure a smooth transition of assets to your heirs while minimizing tax implications.

This planning includes gifting strategies, trusts, and other legal structures designed to protect your wealth and ensure it is passed on according to your wishes. Professional services provide the expertise needed to navigate the complexities of estate planning and develop strategies that align with your goals.

Setting up legal documents like trusts and wills is vital to protect your assets and outline your wishes. Financial advisors and estate planners can guide you through the process, ensuring your estate plan is comprehensive and legally sound. This assistance helps prevent potential legal issues and ensures that your estate is managed according to your directives.

Risk Management and Insurance

Risk management and insurance are essential components of a robust financial plan. Identifying gaps in your insurance coverage can protect you against unforeseen events.

Professional services can evaluate your current policies and recommend necessary adjustments to ensure you have adequate protection. This evaluation includes assessing your needs for various types of insurance, such as health, life, disability, and property insurance.

Ensuring your existing policies provide sufficient coverage at competitive rates is essential for cost-effective risk management. Financial advisors can help you optimize your insurance portfolio to balance coverage and affordability. This optimization ensures that you are not overpaying for insurance while still maintaining the protection you need.

Education and Support

Financial literacy programs offered by professional services can empower you to make informed decisions. These programs provide workshops and resources to enhance your understanding of financial concepts such as budgeting, investing, and retirement planning.

By improving your financial literacy, you can take control of your financial future with confidence. One-on-one guidance from a financial coach can help you navigate complex financial decisions and develop strategies tailored to your situation.

This personalized support can be invaluable in achieving your financial goals. Financial coaches provide the expertise and encouragement needed to make informed decisions and stay on track with your financial plan.

Financial literacy programs and personalized coaching not only empower you to manage your finances effectively but also enable you to make strategic decisions when planning travel, ensuring a seamless integration of both financial and lifestyle goals.

Technology Integration

Utilizing financial management tools can simplify financial management and enhance your ability to track spending, manage investments, and plan budgets. Financial advisors can recommend the best tools for your needs and help you integrate them into your financial routine. These tools provide real-time insights and analytics that support better financial decision-making.

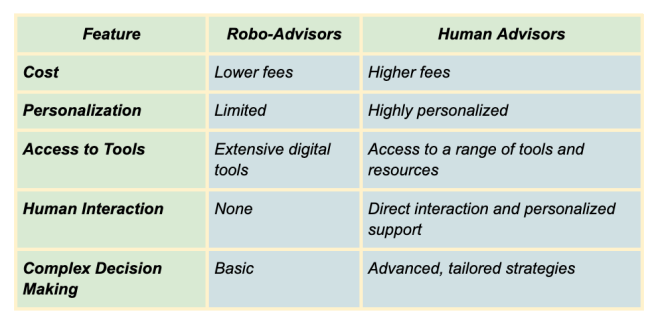

Evaluating the benefits and limitations of automated financial services compared to human advisors is essential for making informed choices. While robo-advisors offer convenience and cost savings, human advisors provide personalized guidance and expertise. By understanding the strengths and weaknesses of each option, you can choose the approach that best suits your financial needs.

Regular Reviews and Adjustments

Conducting comprehensive reviews of your financial situation on an annual basis helps adjust strategies based on life changes and market conditions. These check-ups ensure that your financial plan remains relevant and effective.

Regular reviews allow you to make proactive adjustments to your financial plans, ensuring that you stay on track with your goals. Making timely modifications to your financial plans is essential for staying on track with your goals.

Professional services can provide the insights and recommendations needed to adapt your strategies proactively. By staying engaged with your financial plan and making adjustments as needed, you can ensure that your financial health continues to improve over time.

Education Planning

Education planning is an essential aspect of managing your finances, especially if you have children. Professional financial services can help you establish education savings accounts such as 529 plans, which offer tax advantages for saving for college expenses.

Advisors can help you estimate future education costs and develop a savings strategy that aligns with your financial goals. This planning ensures that you are financially prepared for your children’s educational needs without compromising your other financial priorities.

Moreover, financial advisors can guide you through the process of applying for financial aid and scholarships. They can help you understand the various options available and assist in completing applications accurately and efficiently. By leveraging their expertise, you can maximize the financial support your child receives, reducing the burden on your savings.

Charitable Giving

Incorporating charitable giving into your financial plan can be a rewarding way to support causes you care about while also benefiting from potential tax deductions. Professional services can assist in creating a charitable giving strategy that aligns with your philanthropic goals and financial situation.

Advisors can help you choose the most effective methods of giving, such as setting up donor-advised funds, charitable trusts, or direct donations. By structuring your charitable contributions strategically, you can maximize the impact of your donations and receive tax benefits.

Financial advisors ensure that your giving plan is both meaningful and tax-efficient, allowing you to support your favorite charities without compromising your financial health.

Business Financial Planning

If you own a business, professional financial services can play a crucial role in managing both your personal and business finances. Advisors can help you with business financial planning, including cash flow management, budgeting, and financial forecasting.

They can provide insights into optimizing your business operations and improving profitability. Business financial planning also involves succession planning, ensuring a smooth transition of ownership when you decide to retire or sell your business.

Advisors can help you develop a comprehensive succession plan that addresses your business's financial and operational aspects, protecting your legacy and securing your retirement.

Legacy Planning

Legacy planning goes beyond traditional estate planning by focusing on the values and impact you want to leave behind. Professional financial services can help you create a legacy plan that reflects your personal values and ensures your wealth is used in ways that are meaningful to you. This might include setting up family trusts, creating foundations, or establishing scholarships.

Advisors can guide you through the legal and financial aspects of legacy planning, ensuring that your wishes are clearly documented and legally binding. By planning your legacy thoughtfully, you can make a lasting impact on your family, community, and the causes you care about, while also providing for future generations.

Wrap Up

Professional services offer invaluable expertise and personalized strategies to help you manage your finances better. Whether it's financial planning, investment management, tax optimization, or retirement planning, professional advisors provide the guidance and support needed to achieve your financial goals.

Take the first step towards better financial health by consulting a financial professional today.

FAQs

- How can professional services help me with my retirement planning?

Professional services assist you in selecting the right retirement accounts, maximizing contributions, and developing strategies to ensure a steady income stream during retirement.

- What are the benefits of working with a financial advisor for tax planning?

A financial advisor can help you implement tax-efficient strategies, identify applicable deductions and credits, and reduce your overall tax liabilities.

- How can financial services aid in education planning for my children?

Financial services help you set up education savings accounts like 529 plans, estimate future education costs, and develop a savings strategy that aligns with your financial goals.

- Why is estate planning important and how can professional services assist?

Estate planning ensures a smooth transfer of assets to your heirs while minimizing tax implications. Professional services help create comprehensive estate plans, including wills and trusts, to protect your assets and outline your wishes.

- What role do financial advisors play in managing investment portfolios?

Financial advisors assist in asset allocation and diversification, ongoing portfolio monitoring, and making adjustments to ensure your investments align with your financial goals and market conditions.